Toronto home prices in 2026 have corrected back to late 2020 levels. See updated condo, townhouse, semi-detached and detached prices and what it means for first time buyers.

If you are researching Toronto home prices in 2026, the data tells a very clear story.

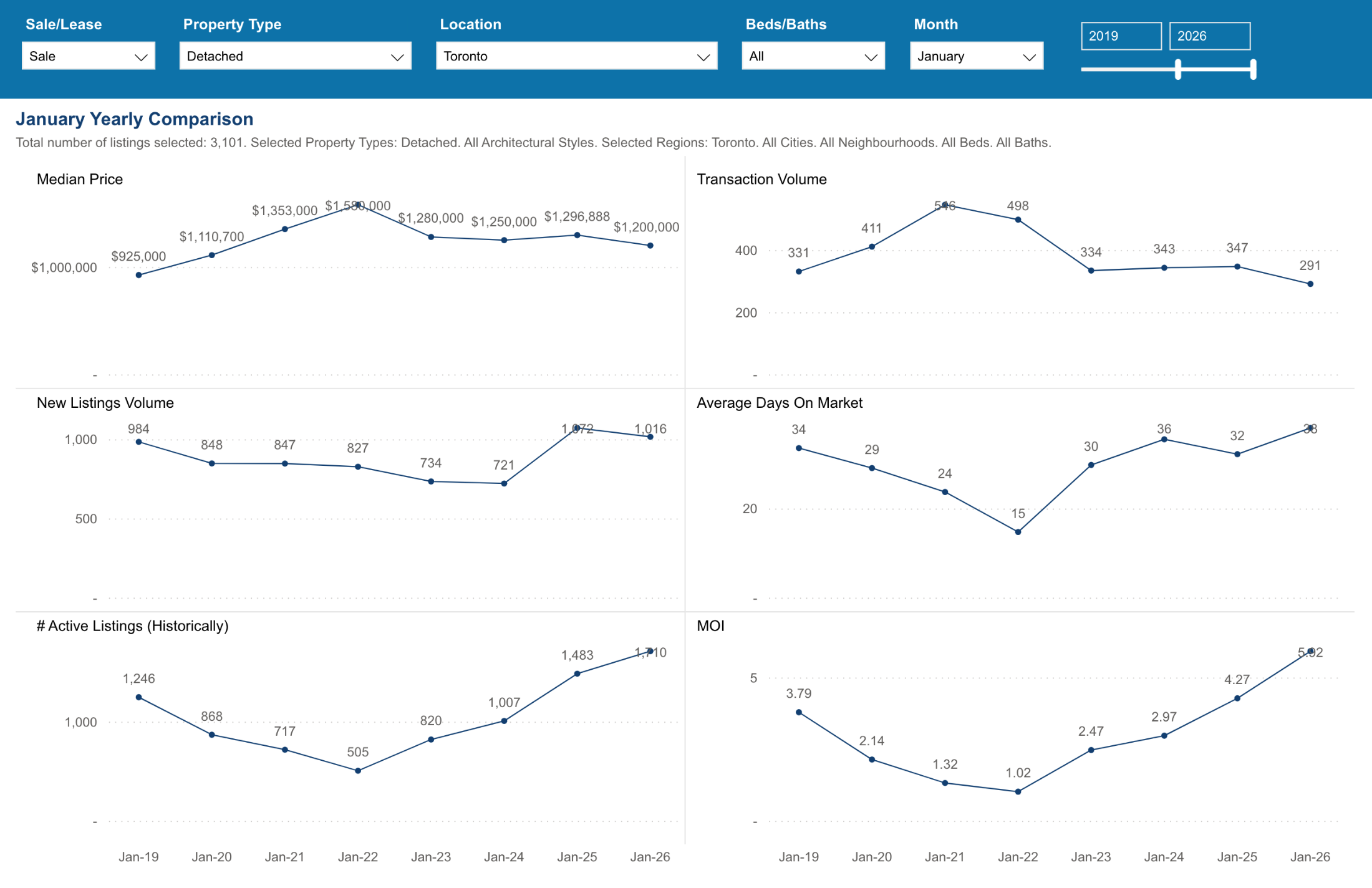

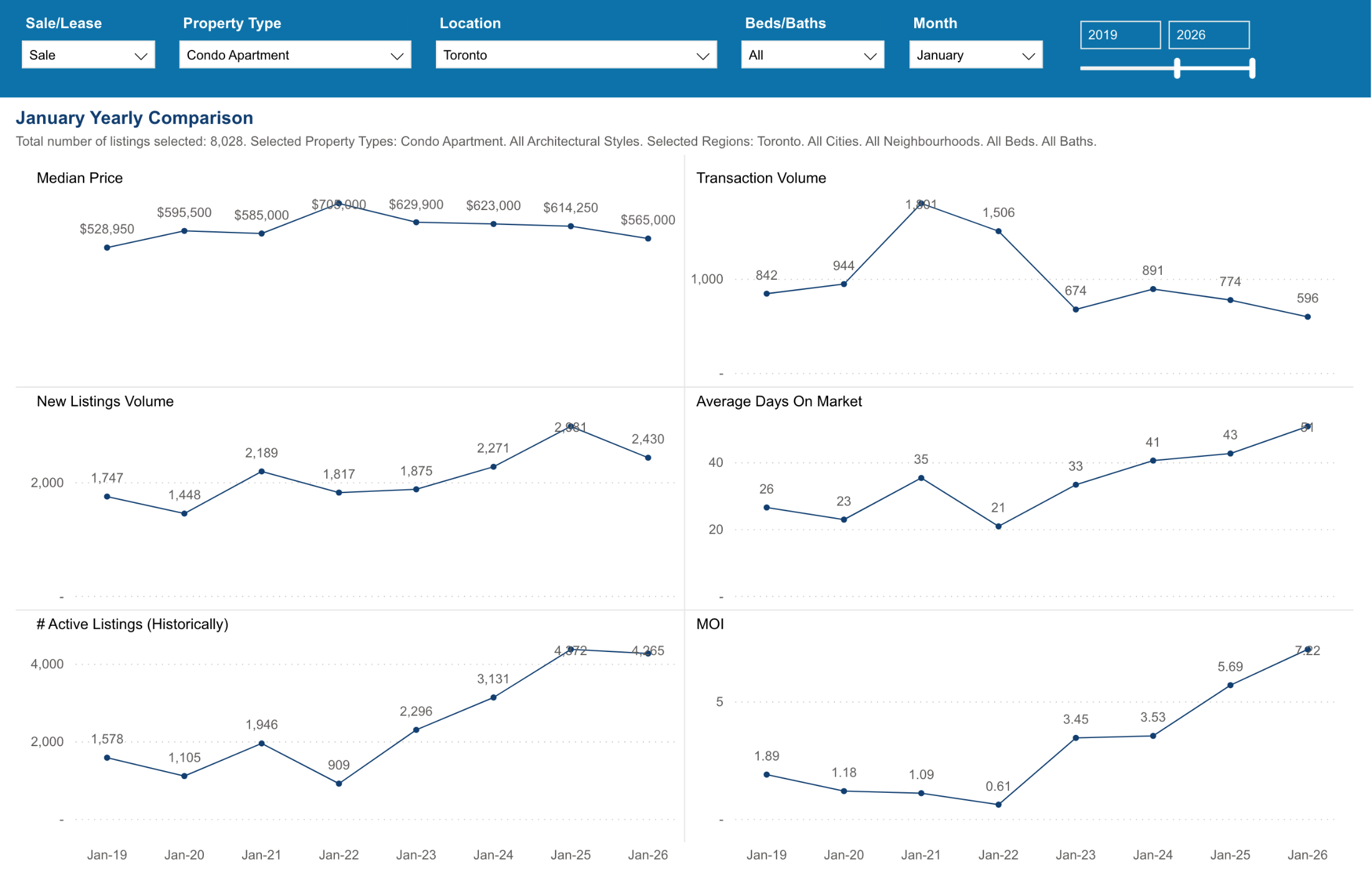

After the aggressive run up in 2021 and early 2022, the Toronto housing market has largely corrected back to late 2020 and early 2021 pricing levels.

This is not speculation. This is visible directly in the median sale price data across all property types.

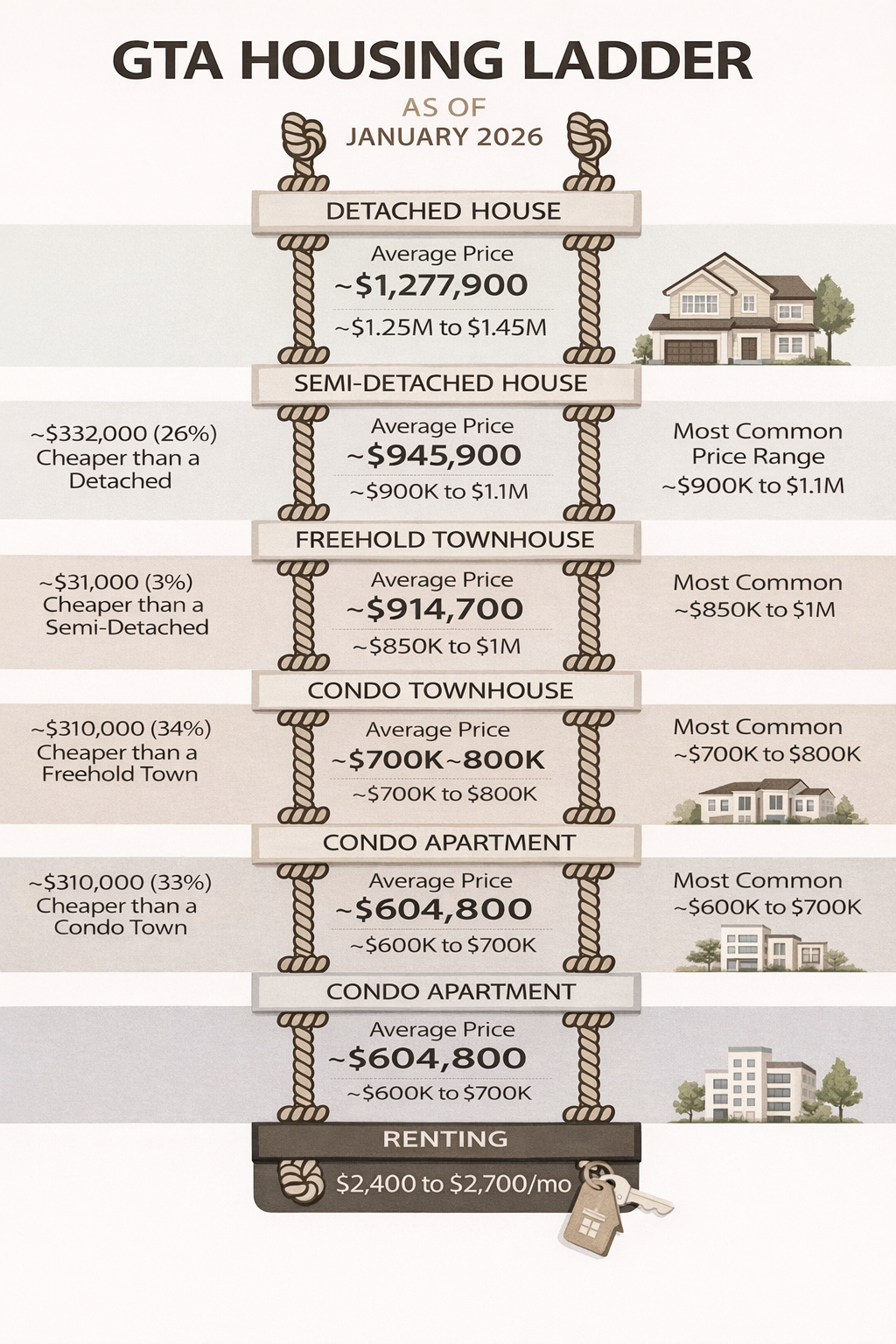

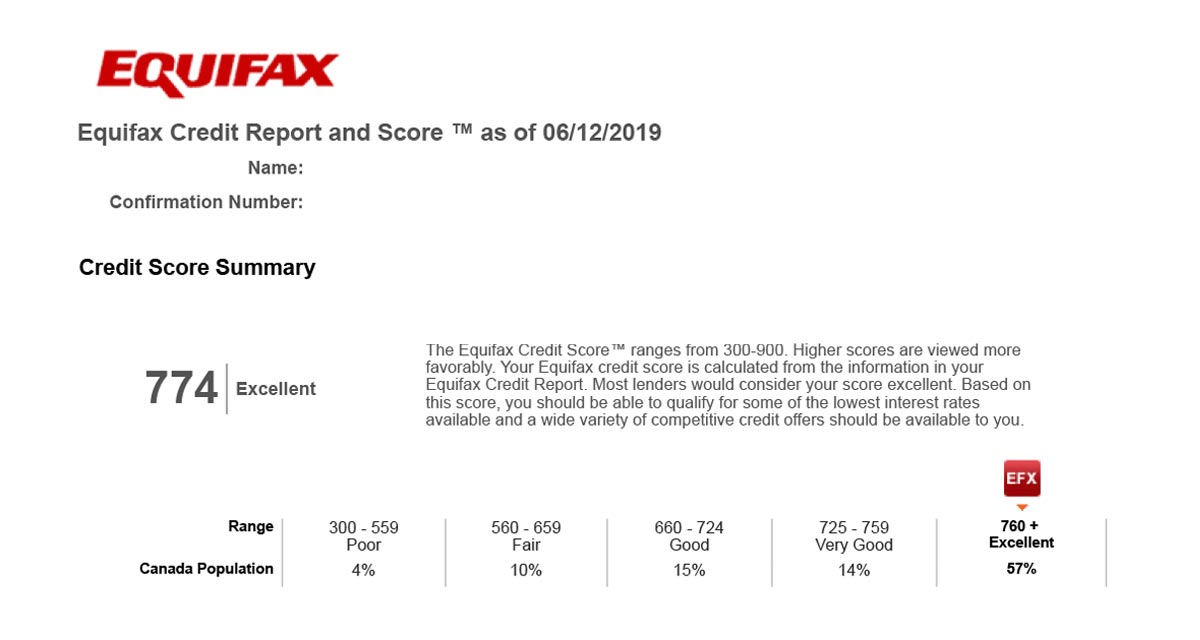

As of January 2026, median home prices in Toronto are:

• Detached: $1,200,000

• Semi Detached: $994,000

• Condo Townhouse: $692,500

• Condo Apartment: $565,000

When you compare these numbers to historical pricing, something important stands out.

Talk to Elie

Toronto Real Estate Prices Have Reset to 2020 Levels

Looking at monthly median sale prices from January 2020 through January 2026:

Condo apartment prices around $565,000 were last seen in mid 2020.

Condo townhouses near $690,000 were typical in late 2020.

Semi detached homes around $990,000 closely match late 2020 pricing.

Detached homes around $1.2M were common in late 2020 and early 2021, before the speculative surge.

In other words, the majority of the 2021 to early 2022 premium has been removed from the market.

Toronto detached home prices and Toronto condo prices have effectively repriced to what buyers could sustainably afford before ultra low interest rates distorted demand.

What Happened Between 2021 and 2022

From early 2021 to Q1 2022, Toronto real estate entered a speculative phase.

Detached homes surged above $1.6M.

Semi detached homes moved well beyond $1.3M.

Condo townhouses approached $900,000.

Condo apartments climbed into the high $600,000 range.

This was driven by:

• Ultra low mortgage rates

• Cheap variable financing

• Pandemic driven space demand

• Investor speculation

• Fear of missing out

Months of inventory collapsed. Days on market compressed. Buyers competed aggressively.

That was not normal market behavior. That was a liquidity driven expansion.

Then rates rose. Affordability tightened. The market corrected.

Toronto Condo Prices in 2026

Today, Toronto condo prices reflect normalization rather than collapse.

At $565,000 median for condo apartments, prices are back to 2020 affordability levels.

Inventory is higher. Investor activity has cooled. Buyers are more disciplined.

For end users, this creates a more stable entry point compared to the speculative peak.

Condo townhouses at $692,500 remain attractive for buyers seeking more space without entering detached price territory.

Toronto Detached Home Prices in 2026

Toronto detached home prices now sit at $1.2M median.

While this is lower than peak 2022 levels, it is still structurally supported by limited land supply in the city.

The key difference today is psychology.

Buyers are no longer assuming automatic appreciation.

They are stress testing financing.

They are negotiating.

They are making rational decisions.

Are We at the Bottom of the Toronto Housing Market?

No one can perfectly time the market.

However, real estate cycles are stretched out and slow moving.

Markets expand.

They peak.

They contract.

They stabilize.

The data strongly suggests that Toronto home prices in 2026 are moving through the trough phase of the cycle.

Prices have corrected.

Speculative premiums have been removed.

Affordability has recalibrated.

The excess has been washed out.

Why This Is a Strategic Moment for First Time Home Buyers in Toronto

If you are a first time home buyer in Toronto, today’s market conditions are fundamentally different from 2022.

You now have:

• Negotiation power

• More inventory options

• Less bidding competition

• Sellers with realistic expectations

• Pricing that resembles 2020 levels

Buying during euphoria is emotional.

Buying during normalization is strategic.

If you were priced out during the peak, the current Toronto housing market may represent the most rational entry point in years.

You Cannot Time the Market, But You Can Align Your Life

The best time to buy real estate in Toronto is not when headlines say the market is hot.

It is when:

• Your income is stable

• Your down payment is ready

• Your lifestyle needs have evolved

• You are planning for children

• You are upsizing or downsizing intentionally

• Your long term financial plan is aligned

Real estate should serve your life.

Not the other way around.

My Approach to Helping Buyers Navigate Toronto Home Prices

As a data driven Toronto realtor, my focus is not on hype.

It is on:

• Understanding real estate cycles

• Evaluating affordability realistically

• Running stress test scenarios

• Protecting buyers from speculative behavior

• Building long term equity intentionally

You can never perfectly time the Toronto housing market.

But you can enter it intelligently.

Ready to Buy in Toronto in 2026?

If you are researching Toronto condo prices or Toronto detached home prices and wondering whether now is the right time, let’s build a plan.

Whether you are a first time home buyer, upgrading from a condo, or downsizing strategically, the key is disciplined execution.

The cycle will turn again.

The question is whether you will be positioned correctly when it does.

If you want to explore your options, run affordability scenarios, or understand which property type fits your long term goals, reach out.

Let’s build your strategy based on data, not emotion.

Talk to Elie

More Trend Charts for Condos and Detached homes