Selling a property in Toronto is a complex process influenced by a variety of factors, from economic conditions to the timing of the real estate market, the neighbourhood, the building, and even the property itself.

One of the most crucial elements, however, is accessibility. How easily buyers can envision themselves in the space. This becomes especially important when considering the data: in 2024, only 21% of tenanted condo listings sold, compared to 38% of owner-occupied or vacant units.

Tenanted condos face a tougher market, making it essential for sellers to approach the process strategically while remaining compliant with LTB rules and regulations.

With limited options available to sellers and landlords in Ontario, here are 3 key strategies to consider when selling your property and ensuring it remains attractive to potential buyers.

3 Main Approaches

Option 1

Buyer Assumes Tenant

Simplicity Level: High

How It Works:

Seller lists the property and sells it with the tenant remaining in place

The buyer takes over as the new landlord

Key Condition:

Valid for most lease terms

The tenant’s lease remains unchanged, and the new owner must honour the existing rental terms

Risk of Tenant Refusal:

No risk, the tenant remains

Option 2

Mutual Agreement (N11 Process)

Simplicity Level: Medium

How It Works:

The landlord and tenant negotiate a mutual agreement to end the tenancy prior to a sale

Terms are set by Landlord and Tenant

Often involves financial compensation known as "Cash for Keys"

Key Condition:

Valid for most lease terms

Requires a tenant's voluntary agreement to terms they set out with the landlord

Typically includes a financial settlement in exchange as

Risk of Tenant Refusal:

If the tenant refuses to sign, the landlord must sell with the tenant in place or pursue an N12 instead

Option 3

Buyer’s Own Use (N12 Notice)

Simplicity Level: Low

How It Works:

Seller lists the tenanted property for sale

If the buyer wants to move in, the seller serves an N12 notice once the deal is firm

Seller serves N12 with 60+ days’ notice & pays 1 month’s rent as compensation

Key Condition:

Only valid for month-to-month lease terms

If the tenant has a lease, they can stay until it ends

Risk of Tenant Refusal:

Tenants can dispute the N12 with the Landlord and Tenant Board (LTB), delaying the process

If they refuse to move, the buyer must handle the eviction

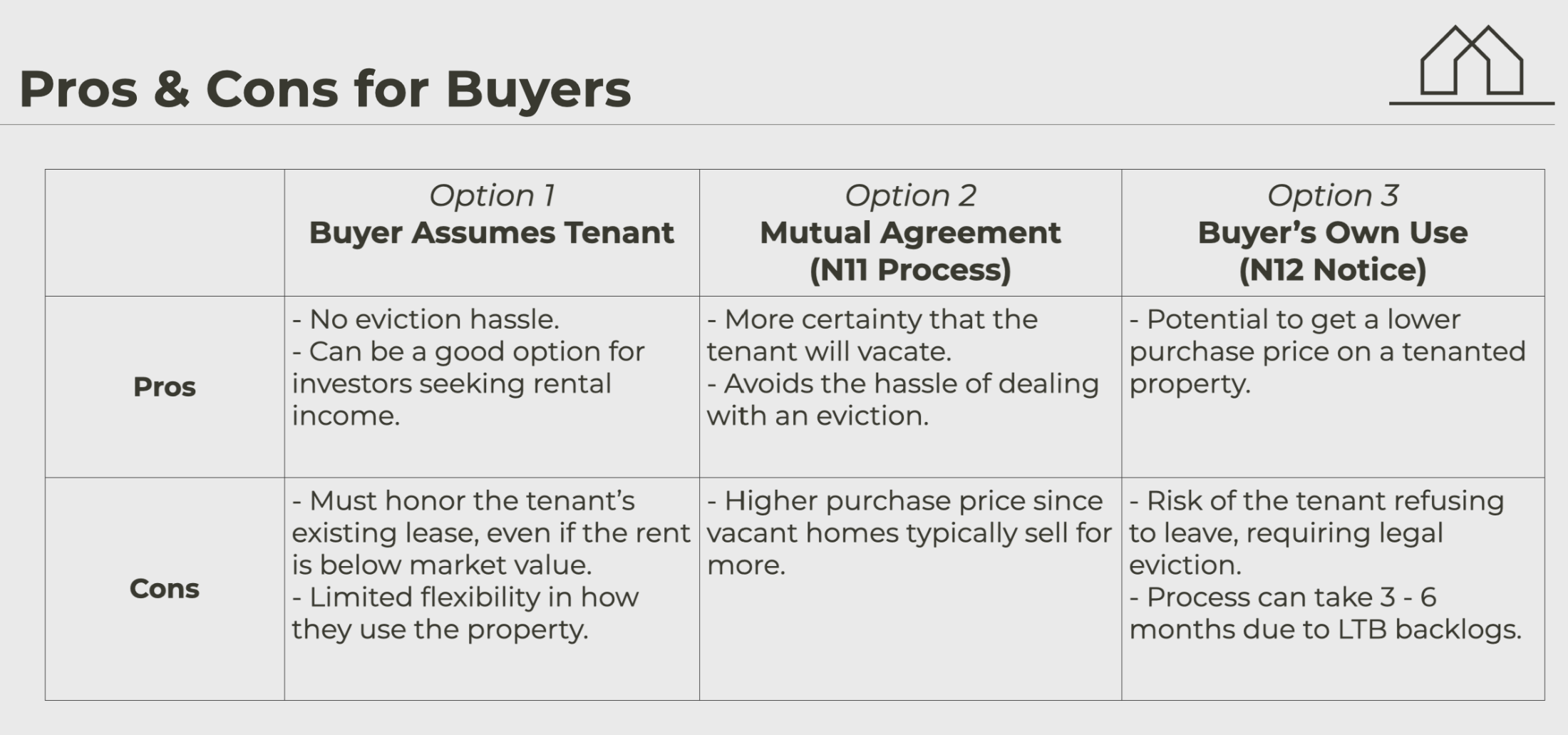

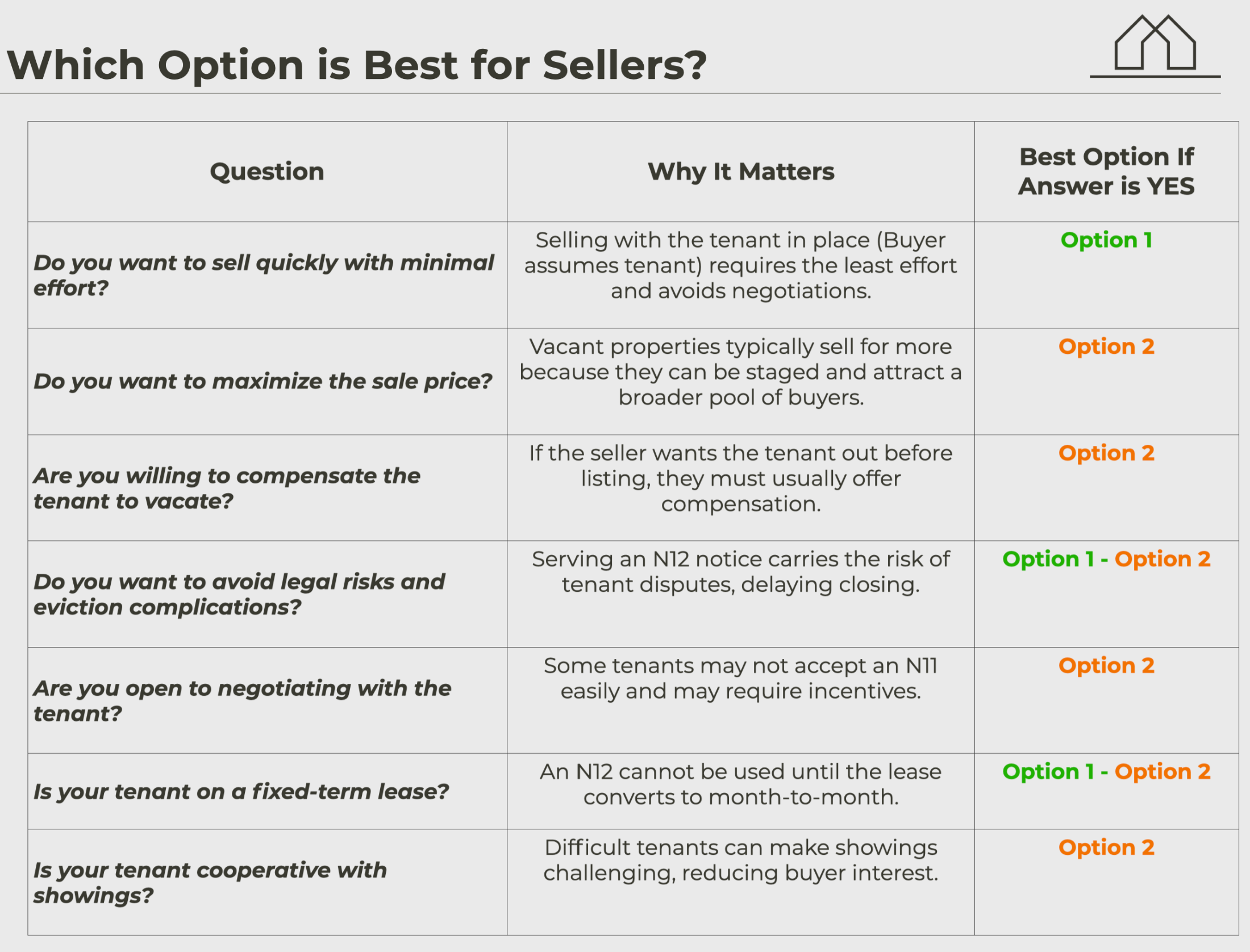

From the Seller's Perspective

Suppose you can achieve a higher sale price by painting and staging your property. In that case, it's in your interest to negotiate an N11 agreement with your tenant and have them vacate before you begin marketing the property for sale. In most cases, a vacant property will sell for more than a tenanted property.

Even if you don’t want the tenant to move out immediately, agreeing to the basic terms of an N11 will ensure your sale process is much smoother because most buyers today are asking for a signed N11 rather than an N12 notice.

The downside is that you'll have to spend some money to compensate your tenant.

From the Buyer's Perspective

You can be far more confident that the tenant will move out by the closing date if they have signed an N11.

There is still a slim chance that the tenant will not move out, but this is less common when tenants sign an N11. You can try to include a clause requiring the Seller to compensate you if the tenant fails to move out on closing.

Disclaimer: This information is provided for general informational purposes only and should not be considered legal or professional advice. I am not an expert on the Residential Tenancies Act (RTA), and sellers should consult the Landlord and Tenant Board (LTB) or seek legal guidance to ensure they are following the correct procedures and regulations.