If you're looking to buy a home in Toronto, you're about to embark on an exciting journey! Toronto's real estate market is dynamic, and navigating it can be a bit overwhelming. But don't worry—by following these 8 essential steps, you’ll be well-prepared to find your dream home in this vibrant city.

1. Do Your Research

Before diving into Toronto's competitive housing market, it's crucial to research and prepare thoroughly.

Here’s how to get started:

Understand Current Market Trends

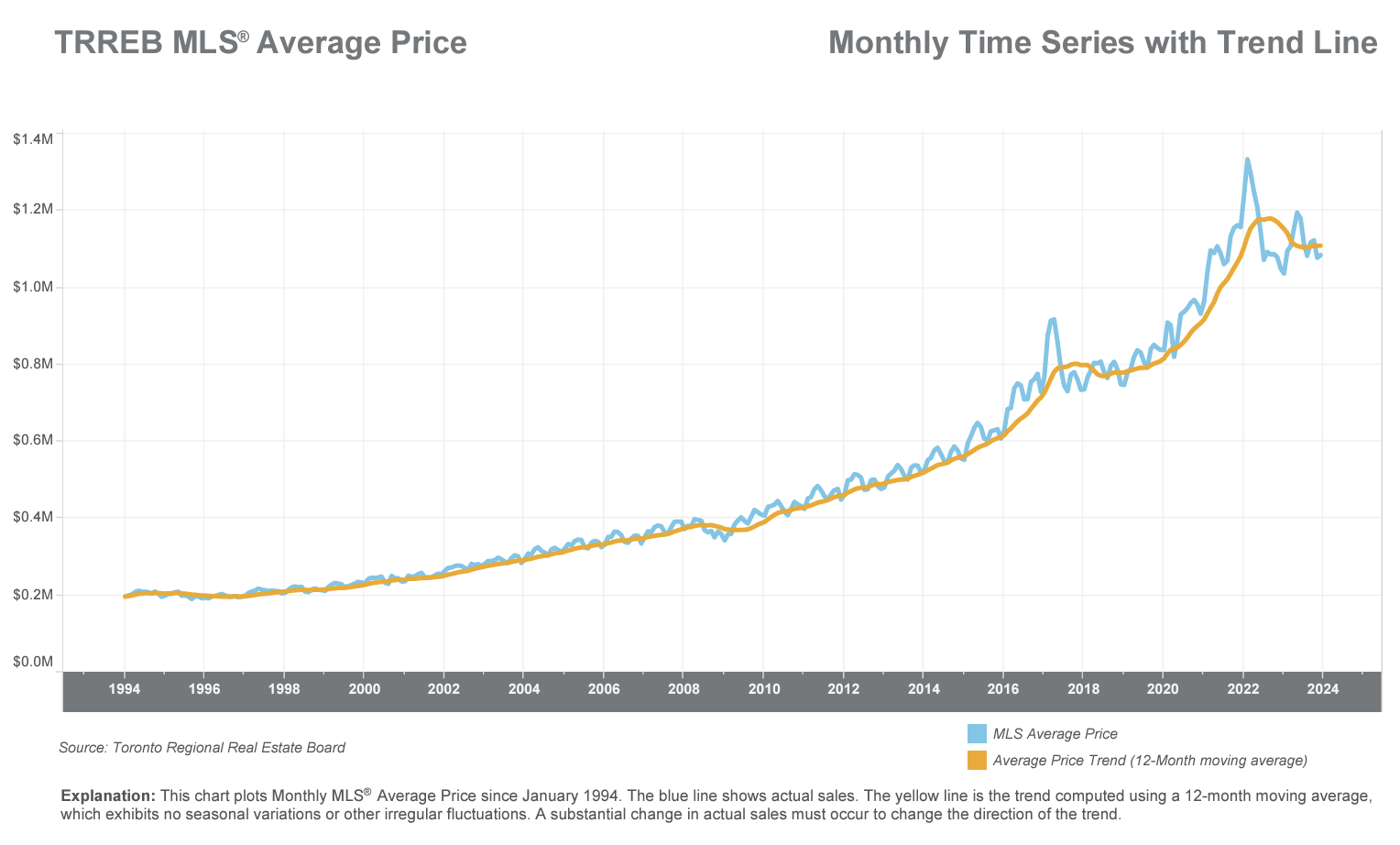

Toronto’s real estate market can be fast-paced and competitive. Stay informed about the latest trends, including average home prices, market fluctuations, and future predictions. This knowledge will help you make informed decisions and avoid surprises during your home-buying journey.

Familiarize Yourself with Different Neighbourhoods and Property Types

Toronto offers a range of neighbourhoods, each with its own unique character. Take time to explore different areas to find one that aligns with your lifestyle and preferences. Consider property types as well—whether you’re looking for a condo, townhouse, or detached single-family home.

Start browsing MLS listings in the neighbourhoods you’re interested in and attend open houses. Pay close attention to home prices and how long properties stay on the market. For a convenient way to track home costs, use the Browse Properties map search on our website to search for properties and add them to your Favourite List.

Identify your priorities and distinguish between your must-haves and nice to-have property features.

Must-haves are non-negotiable requirements like:

Open Floor Layout

Large Open Kitchen with South/East Exposure

Master Bedroom with Walk-in Closet and Ensuite Bathroom

Large Lot with Good Outdoor Space

2 Car Garage

3 Bedrooms

Space for 2 Home Offices

Closet/Storage Space

Nice-to-haves are negotiable requirements like:

Gas Stove

Amenities

Finished Basement or Space to Finish

Laundry Room Not in the Basement

Mudroom with Storage

Level Driveway

Determine Your Budget

Calculate your budget early on. Toronto is Canada's most expensive housing market, so understanding your financial limits is crucial. Consider both your down payment and closing costs to ensure you’re financially prepared.

Research housing prices in the areas you're interested in to avoid surprises. Use my Mortgage Payment Calculator to estimate monthly payments based on your budget. This will help you stay within your financial limits and find a property that fits your needs.

If you’d like to delve deeper into the finances of buying a home and evaluate how your financial situation looks like over the next 5 years, check out my Real Estate Financial Calculator and get your Free Copy whenever you’re ready.

By thoroughly researching these aspects, you'll be better prepared to work with a realtor and find a property that fits your lifestyle, location preferences, and budget in Toronto's competitive market.

2. Find Your Realtor

In a city of over 50,000 real estate agents, choosing the right one can be daunting. Referrals from friends and family are a great starting point, but it’s important to do your own research as well.

Here are a few quick tips to help you find the best real estate agent in Toronto:

Look at Reviews and Deals

Check online reviews and past transactions to gauge an agent’s reputation. Look for agents with positive feedback and a strong track record of successful deals.

Evaluate Their Online Presence

Check online reviews and past transactions to gauge an agent’s reputation. Look for agents with positive feedback and a strong track record of successful deals.

Choose an Agent Familiar with Your Desired Neighbourhood

An agent who knows the intricacies of your preferred neighbourhood can offer valuable insights and help you find the right property. If you’re busy and want to explore Toronto’s most exciting neighbourhoods, I’ve got you covered. Go checkout his Neighbourhood Walking Tours on Youtube.

Assess the Quality of Their Listings

Examine the quality of their property listings. Professional photography and detailed descriptions often indicate a high standard of service and attention to detail.

Trust Your Instincts

Trust your gut feeling. If you have any reservations about an agent, don’t hesitate to explore other options. With so many agents in Toronto, there’s bound to be one who suits your needs perfectly.

Find the Right Fit

Make sure you and your realtor are on the same page. Whether you’re looking for a rational approach or a more emotional one, it’s essential that your agent aligns with your style. For example, if you want a more data-driven and fact based approach to decision-making, I’m is here to provide you with all the knowledge you need to make a well informed decision.

Once you’ve found the right real estate agent, they’ll set up a prospect match to send you new MLS listings that match your criteria. If you’re the type of buyer who enjoys exploring neighbourhood statistics and market analytics, feel free to get in touch. We can start with a quick 15-minute intro call to discuss your plans and go over some valuable reports and market trends.

3. Get Pre-Approved for a Mortgage

The first thing your real estate agent is going to have you do is to get a mortgage pre-approval. A mortgage pre-approval will let you know how much mortgage banks/lenders are willing to give you to spend on a home.

You may even consider doing this ahead of finding your realtor so that you can get the ball rolling right away. If you’re buying a house in Toronto, this is going to give you a realistic idea of what you can actually afford relative to your current income level and mortgage interest rates.

A mortgage pre-approval clarifies your monthly mortgage carrying costs to ensure there are no surprises. A potential lender will require you to show your income, credit score, and disclose your debts. Once approved, you will receive a letter that includes an interest rate guarantee, typically valid for 90 to 120 days.

4. Visit Properties

With your research, realtor, and mortgage pre-approval in hand, it’s time to start visiting properties. Attend open houses and schedule private viewings to get a feel for different homes. Take note of the property’s condition, layout, and location.

One thing to know—especially for the first-time homebuyer—is that when your realtor takes you on showings, you’re likely going to see a lot of properties back-to-back. It can be a lot to remember, so it’s never a bad idea to take some notes while on the showings. Take note of the things you liked and didn’t like so you can review them later with a clear mind. After a day spent seeing 10, maybe even 20 different properties, you’ll be grateful you did.

Don’t rush this process—finding the right home takes time, and it’s essential to explore all your options to make an informed decision.

5. Get the Deposit Money Ready

In Toronto’s hot real estate market, the deposit is a critical component of a successful offer. It’s essential to have access to cash on hand when searching for a home or condominium. Being able to withdraw funds for the deposit cheque (preferably a Certified Cheque) at a moment’s notice is essential.

Deposit = Accessible Cash

Many buyers find themselves scrambling to access funds from RRSPs, FHSA, and Stocks or Bonds investments, which isn’t always a quick or easy process. If you bank with institutions like Wealthsimple or Tangerine, which don’t have physical branches, you may face additional delays as you work with their sister companies to gather your deposit.

You shouldn’t be surprised when your realtor tells you the deposit is due ASAP! In a competitive market, a seller’s market, having your deposit funds ready can make a significant difference. While it’s not always necessary to submit your deposit cheque with your offer, especially if you’re not in a bidding war, doing so can strengthen your position.

The deposit, typically 5% of the purchase price, is usually required within 24 hours of offer acceptance unless otherwise specified. However, in today’s competitive marketplace, submitting your deposit cheque with your offer—even when not in a bidding war—signals to the seller that you’re serious and committed, which can be a decisive factor in securing the property.

6. Make the Offer

When you find a place that you’re absolutely in love with and decide to make an offer, it’s important to manage your expectations. Toronto’s real estate market is highly competitive, and it’s not uncommon for homes to receive multiple bids. Don’t be too discouraged if you don’t secure the first home you bid on—be prepared for the possibility of losing before you win.

Whether you’re competing against other buyers or simply want to make a great first impression, there are steps you can take to strengthen your bid. By optimizing each detail, you can help ensure that the package you put together is as appealing as possible. Here are a few tips for making a highly attractive offer on a home:

Increase Your Deposit: Offer a higher deposit to show seriousness and make your offer more appealing

Make the Offer as Clean as Possible: Remove as many conditions as you can to simplify the process for the seller

Don’t Lowball: Avoid low offers; consider starting with your highest possible bid in a competitive market

Consider Writing a Letter: Add a personal touch by writing a sincere letter to the sellers

Be Flexible with Your Closing Date: Adjust your closing date to fit the seller's needs for added appeal.

The offer process can be stressful, especially in a competitive market like Toronto. Fortunately, working with an experienced agent can help you feel more confident without compromising your position. Their guidance can make all the difference between securing your ultimate home and losing out to another buyer.

7. Home Inspection

A home inspection is a crucial step when buying a house in Toronto, especially for older homes. It can reveal hidden issues, from minor repairs to major structural problems, saving you from unexpected expenses later. Many buyers make their offers conditional on a home inspection, giving them the option to renegotiate or walk away if serious issues are found.

However, in Toronto's competitive market, some buyers choose to waive this condition to make their offer more appealing. While this can strengthen your bid, it’s risky—especially with older properties that might have hidden problems. Consult with your realtor before deciding whether to skip the inspection, as it could lead to costly surprises after the purchase.

8. Close the Deal

Once your offer has been accepted, congratulations—you’re officially on your way to becoming a homeowner! However, there are still a few crucial steps to finalize the process. Be prepared to sign a lot of paperwork as you work closely with your mortgage broker and real estate lawyer to finalize your mortgage and complete the legal transfer of the property. To make the process as convenient and efficient as possible, professionals nowadays rely on secure digital signing such as DocuSign so you can handle paperwork without the hassle.

During this stage, you'll also need to pay your closing expenses, which include costs like Land Transfer Tax and legal fees. If you’re a first-time homebuyer, don’t forget to check for any First-Time Home Buyer Incentives that could save you money.

Finally, if you’re looking to buy a place in Toronto, my full-service team is here to help you with every step of the home-buying process. I have access an extended network of professionals from mortgage brokers to lawyers to make your move as smooth as possible.